Nvidia stock is up nearly 800% in the past 18 months.

Artificial Intelligence (AI) is one of the hottest industries for investors right now. Semiconductor lover and specialist in the data center Nvidia (NVDA Image 1.44%) is seen by many on Wall Street as a great opportunity for AI enthusiasts.

With Nvidia shares up more than 170% year to date in 2024, some investors may think they’ve missed the boat.

Let’s take a look at what’s going on at Nvidia, and check if now is still a good time to stock up.

Nvidia’s hot start until 2024

2023 marked a new era for the technology industry. Behemoths like Microsoft, Alphabetand Amazon have all made a series of splashy investments around AI applications.

Some of the biggest investments made by these technology groups were to buy AI-powered semiconductor chips, as well as to upgrade data center services. Considering that Nvidia has an estimated 80% share of the AI chip market, there is no doubt that these big tech moves have helped the company.

A strong continuation from last year’s AI euphoria carried over into 2024, and Nvidia investors haven’t stopped buying the stock. To put this into context, Nvidia’s shares are up nearly 800% since January 2023.

This unprecedented move briefly pushed Nvidia over Microsoft as the world’s most valuable company by market value. In addition, as shares continue to exceed new heights, Nvidia executives finally decided to implement a 10-for-1 dividend last month.

Image source: Getty Images.

Nvidia is not the only gaming platform

Surprisingly, much of the story surrounding Nvidia deals with the company’s chip business. Indeed, its H100 and A100 graphics processing units (GPUs) are used by companies around the world – including. Meta Platforms and Tesla.

Additionally, Nvidia continues to lead innovation in the GPU space with the introduction of its new Blackwell and Rubin chips.

That being said, it is important to understand that Nvidia makes money from other products and services as well. In fact, one of its untapped growth opportunities is outside of hardware.

Nvidia’s compute unified device architecture (CUDA) software platform is already proving to be a profitable business. Basically, CUDA is a programming tool that is intended to be used in parallel with Nvidia GPUs. So, in a sense, the company is trying to build an end-to-end AI environment that includes both hardware and software.

One of the big reasons that CUDA will be important to Nvidia is because of the competition in the chip space. Companies like AMD, Inteleven Amazon and Meta are all working on GPUs competing with Nvidia.

Although it is too early to understand how these competing products will affect Nvidia, I think it is safe to say that the company will eventually lose its pricing power in the chip space. As a result, Nvidia’s profit potential may have some impact in the future. However, some of this edge damage should be mitigated as long as CUDA continues to thrive. This is because software products tend to carry higher bandwidth than hardware.

Is now a good time to invest in Nvidia stock?

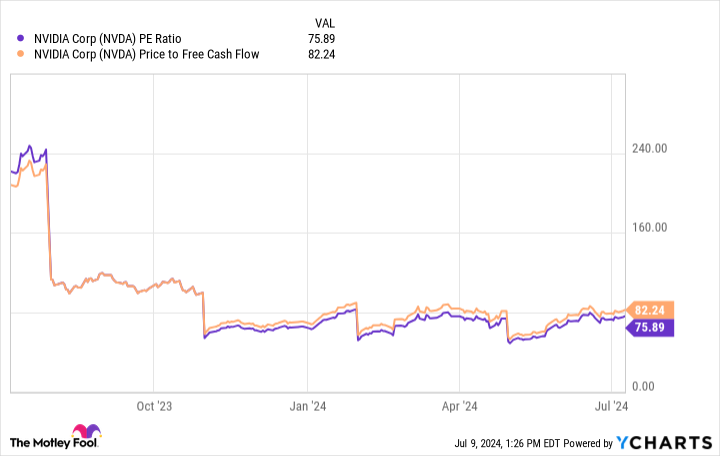

The chart below shows Nvidia’s price-to-earnings (P/E) and price-to-free-cash-flow (P/FCF) ratios over the past 12 months. While a P/E of 75.9 and a P/FCF of 82.2 may seem expensive, there are a few ideas to consider here.

NVDA PE Ratio data by YCharts

First, Nvidia’s P/E and P/FCF multiples are lower than they were last year. In other words, even though the stock price is rising rapidly, Nvidia’s earnings and cash flow are growing at a faster rate – therefore, Nvidia stock is not cheaper today than it was in the past. there in the last 12 months.

Additionally, Nvidia’s leadership in the chip space and its under-the-radar software services should be explored further. The company is an investor in Databricks, one of the most important AI start-ups in the world. Nvidia is also an investor in Figure AI — a developer of humanoid robots.

I don’t think the opportunities in robotics and AI software are cheap in Nvidia stock right now. I think most of these applications are currently being covered by the chip’s commercial performance, and many investors are discounting Nvidia’s capabilities elsewhere in the AI arena.

Long-term investors have the opportunity to gain exposure to many different aspects of AI only through Nvidia. Despite the bullish share price climate, the above valuation analysis, as well as some of the growth opportunities explored make a strong case that Nvidia stock is a good buy right now, and it is likely that there is a greater opportunity to buy.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokesperson for Facebook and sister of CEO of Meta Platforms Mark Zuckerberg, is a member of the board of directors of The Motley Fool. Suzanne Frey, CEO of Alphabet, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has positions and recommends Advanced Micro Devices, Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and silent calls January 2026 $405 at Microsoft. The Motley Fool has a publicity strategy.

#late #buy #Nvidia #stock #10for1 #split #Motley #Fool